CFI Group is pleased to present the Specialty Chemicals Valuation Snapshot for the second semester 2024. This report provides commentary and analysis on current market trends and M&A activity within the Specialty Chemicals sector.

Spotlight:

The chemical sector continues to navigate challenges posed by geopolitical tensions, economic uncertainties, and input cost. In particular, new regulations mandate the use of higher-cost approved materials to replace lower-cost prohibited ones, further straining the cost structure of the industry. However, recent earnings reports indicate a steady recovery in sales volumes, with companies like Arkema reporting improvements as destocking trends subside. Firms have shifted focus from price competition

to operational efficiency, with e.g. Brenntag optimizing costs and operational footprint to enhance profitability.

M&A activity has remained robust, driven by portfolio realignments, consolidations, and strategic acquisitions. Notable deals include BASF’s sale of its Flocculants business to Solenis and the portfolio realignments of Hempel (sale of JW Ostendorf and Schaepmans). Specialty Chemicals have seen strong demand from engineering and semiconductor industries, with the global semiconductor market projected to grow 16% in 2024, fueled by AI and battery electric vehicles advancements.

Looking ahead, the chemical industry is expected to expand at a slower pace than historical trends, facing continued uncertainty from geopolitical shifts and regulatory pressures. However, stable inflation and falling interest rates may fuel M&A activity in 2025, with corporate restructuring and PE investments driving deal flow. PE firms, pressured to deploy capital and monetize assets, may pursue larger transactions as well as add-ons, potentially shaping the industry’s next phase of consolidation.

Global Outlook:

The global chemical industry in 2025 will be shaped by economic pressures, sustainability initiatives, and digital transformation. Our own guess is that economic growth and with it deal activity will significantly

pick up in 2025. While some regions face cost inflation and demand fluctuations, others are leveraging efficiency improvements, high-value product innovations, and strategic production shifts. The market is

projected to reach USD 6.3 trillion, driven by advancements in green chemistry, circular economy practices, and resilient supply chains. Companies worldwide are investing in automation, AI-driven operations, and eco-friendly solutions to enhance competitiveness and long-term growth in an evolving regulatory and consumer landscape.

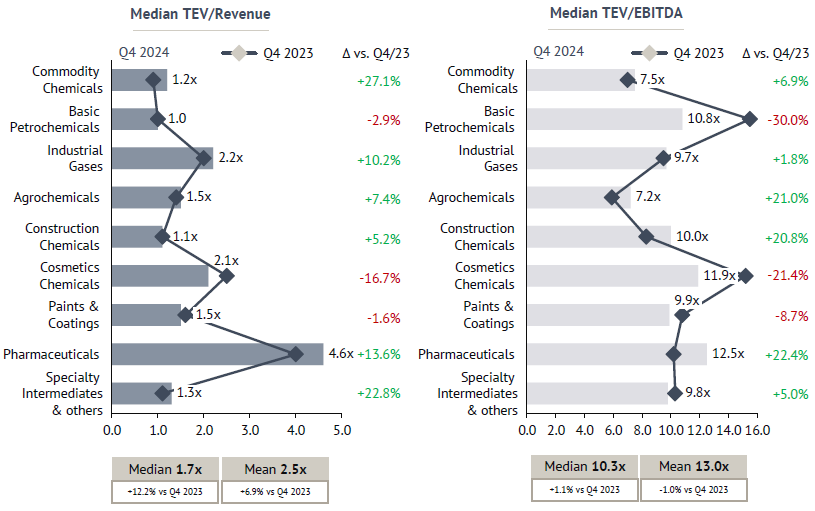

After a substantial increase in valuation multiples in H1/24, both TEV/Revenue and TEV/EBITDA multiples continued to improve in Q4/24, albeit at a slower pace than the surge observed between Q2/23 and Q2/24. Median TEV/Revenue rose by +12.2% YoY, while TEV/EBITDA increased by +1.1% YoY (Q4/23 vs. Q4/24).

The Commodity Chemicals sector experienced the most significant rebound in TEV/Revenue multiples, rising from 0.9x to 1.2x (+27.1% YoY), although on a low level. In contrast, the Cosmetic Chemicals sector saw a decline in TEV/Revenue multiples (-16.7% YoY), reflecting ongoing challenges in demand.

Median TEV/EBITDA multiples generally showed an upward trend, though sectoral variations persist. Agrochemicals posted a substantial increase from 5.9x to 7.2x (+21.0% YoY), second only to Pharmaceuticals, which saw a +22.4% YoY rise. Conversely, Cosmetics Chemicals, Paints & Coatings, and notably Basic Petrochemicals (-30.0% YoY) deviated from this trend, recording declining multiples.

Previously, Basic Petrochemicals held the highest TEV/EBITDA multiples, but Pharmaceuticals have now surpassed them, also leading in TEV/Revenue multiples. Analysts highlight that pharmaceutical companies still maintain significant capital reserves, which they may deploy as opportunities arise, particularly with advancements in AI opening new avenues for growth and efficiency.

The decline in Basic Petrochemicals’ TEV/EBITDA multiples coupled with only a slight decrease in its TEV/Revenue multiple compared to Q4/23, suggests a potential decrease in profitability expectations following a challenging economic environment, particularly in China. This trend may indicate lingering pressures despite overall early signs of recovery.

Construction Chemicals and Specialty Intermediaries reported notable increases in TEV/EBITDA multiples (+20.8% and +5.0% YoY, respectively). Their TEV/Revenue multiples also rose, with Specialty Intermediaries experiencing a stronger surge in their TEV/Revenue multiple (+22.8% YoY). This pattern mirrors developments in Basic Petrochemicals, indicating modest market improvements that are not yet fully reflected in the M&A and stock markets.

Similarly, Industrial Gases followed the trend of Specialty Intermediaries, showing a significant increase in TEV/Revenue multiples (+10.2% YoY) alongside a modest rise in TEV/EBITDA multiples (+1.8% YoY). This suggests growing profitability, supported by favorable global industrial and energy market conditions.

Looking ahead, the chemicals sector faces a complex landscape heading into 2025. Potential shifts in U.S. political policies favouring industry could drive valuation multiples higher, signaling growth prospects and enhanced profitability. However, newly introduced tariffs and trade barriers generally hurt the chemical industry significantly. Despite these challenges, a cautious optimism prevails, with expectations of a gradual market recovery on the horizon.

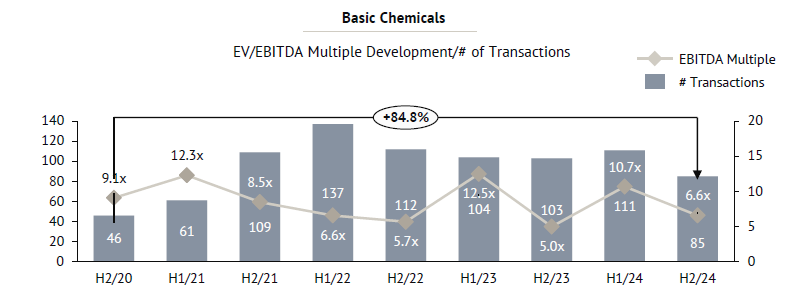

In H2/24, median EV/EBITDA multiples in the Basic Chemicals sector declined, with a drop in transaction volumes. While volumes remain above the all-time low caused by the pandemic, they have yet to recover to peak levels observed in H1/22. With fewer transactions with disclosed multiples, data has become more volatile, leading to significant fluctuations in recent periods.

At the same time, the decline in the median EV/EBITDA multiple in H2/24 suggests that ongoing challenges faced by chemical companies persist. Some of the previous market momentum in H1/24 appears to have cooled, particularly as the Basic Chemicals sector benefits less from private equity interest compared to Specialty Chemicals firms.

Additional pressures stem from shifting customer preferences, with an emphasis on decarbonization, which negatively impacts profitability. As a result, investors are gravitating toward higher-margin Specialty Chemicals businesses, further weighing on valuations in the Basic Chemicals sector.

As in H1/24, the sector remains defined by fluctuating transaction volumes and evolving market dynamics in H2/24. With a growing focus on sustainability and cost efficiency, the trend of acquiring high-quality Basic Chemicals firms may become more pronounced.

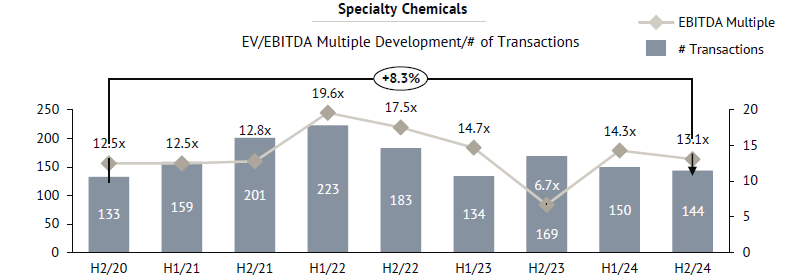

The M&A landscape in the Specialty Chemicals sector has remained relatively stable, with only a slight decline in multiples compared to H1/24. However, in 2024 transaction multiples appear to have gained some momentum compared to 2023 – a trend driven in part by the growing interest of financial investors in the sector.

As highlighted by The Argos Index®, which tracks mid-market transactions, financial investors continue to pay higher multiples than strategic buyers as observed in H1/24. This highlights the sustained and growing interest of private equity, additionally driven by the significant amount of available “dry powder” and the increasing number of LBO transactions.

While the gap between the lowest and highest paid multiples widened last year, this trend appears to be continuing, reflecting growing valuation disparities and increasing premiums. However, these observations should be interpreted with caution, as data on recent transactions in the Specialty Chemicals sector, particularly in the mid-market, may be distorted due to limited disclosure.

Looking ahead to H1/25, private equity is expected to pursue add-on acquisitions, building on their platform investments. This trend will continue to shape the M&A landscape and support transaction volumes

Global Deal Activity –Overview

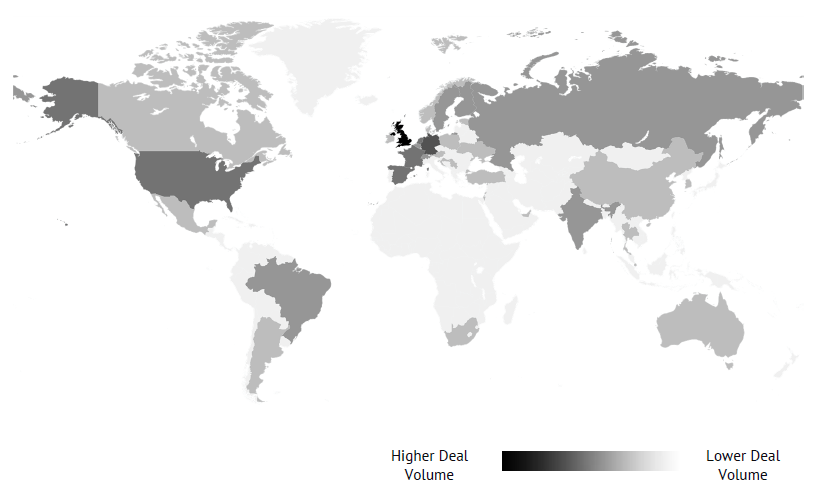

In the global M&A landscape across specialty and basic chemicals, distinct regional trends continue to shape the market.

The United Kingdom, Germany, Italy, and the United States continue to be dominant players in global M&A activity, with strong deal volumes particularly in pharmaceuticals and specialty chemicals. A stable economic environment and ample financial capital, especially from private equity, drive transaction momentum. However, evolving trade regulations and political uncertainties in the U.S. and parts of Europe could introduce potential volatility in deal-making.

China, Japan, India, and South Korea exhibit moderate M&A activity, shaped by distinct economic conditions. While China faces challenges such as declining valuation multiples in certain chemical sectors, private equity interest remains robust in high-margin specialty chemicals. India and South Korea demonstrate steady growth, fueled by industrial demand and an expanding market for advanced materials. Japan, while traditionally conservative in deal-making, remains an active participant, particularly in technology-driven sectors.

Brazil and Mexico lead M&A transactions in Latin America, though overall deal volume remains lower compared to North America and Europe. Agrochemicals and industrial gases emerge as key sectors driving investor interest. Regulatory shifts and economic stability shape investment sentiment, with strategic consolidations and cross-border expansions presenting selective opportunities for growth.

The UAE, Israel, and South Africa feature in the M&A landscape, reflecting growing deal activity in energy, specialty chemicals, and pharmaceuticals. The UAE’s business-friendly policies and financial infrastructure establish it as a hub for cross-regional transactions. Meanwhile, Africa remains a smaller player, though resource-driven industries and infrastructure deals continue to attract international investor interest.

Source: Merger Market